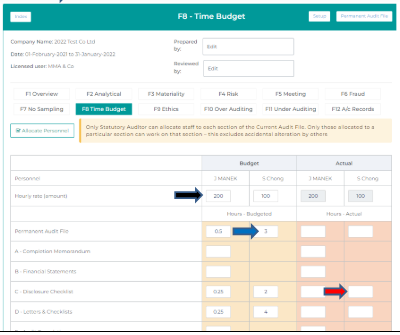

Time Budget, F8 in Audit Planning of InPractice Audit File, enables you to

(a) control the audit work time spent by your audit team

(b) renegotiate the audit fee for any extra time required.

Print/show the Time Budget to your client and renegotiate whether the client can provide:

– Debtors balances age analysis and payments made after the year-end

– Creditors and payments made after the year-end

– Stock valuation analysis

– Investments valuation

– Fixed asset location/photos

See how it looks from

https://inpracticesoftware.com/how-to-use/

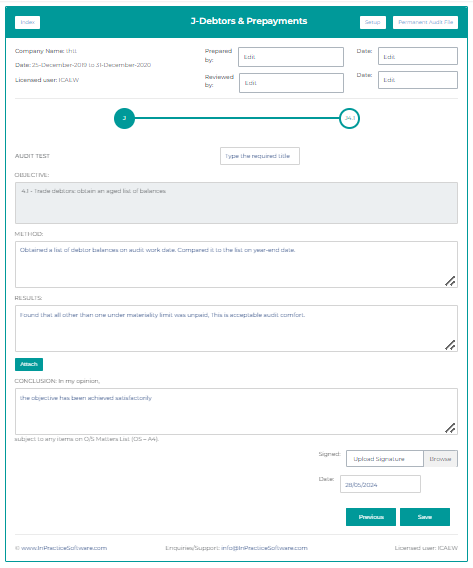

The audit tests are easy to fill in.

Getting your audit licence took you many years of exams, training and specialist skills.

Artificial Intelligence ( AI ) is set to remove many accounting jobs by 2030. Online bank accounts with AI can automatically produce Trail Balance and Management Accounts. As accounting compliance work starts to reduce with AI automation, those with an audit licence can derive income from auditing.

Schools, associations and cultural groups take charity status to lower their tax. Charity status normally requires audit reports.

This has two uses:

(a) Control the time spent and

(b) Renegotiate audit fees if any extra time is required.

International Standards on Auditing ( ISAs ) require a time budget to be prepared during audit planning. Audit Inspectors may ask to see your time budget.

Professional indemnity insurers may ask for the time budget before paying out on a negligence claim.

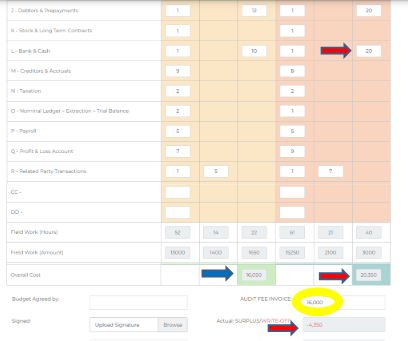

The audit fee quote should have a surplus/profit margin, to compensate for the auditor’s entrepreneurial risk and the auditor’s investment in setting up their audit business. An audit practice is a commercial enterprise after all.

Authorised audit assistants can login on Cloud and enter the InPractice Audit File from wherever, whenever to record their audit work.

Flexibility in working with the Cloud Technology is what younger auditors prefer. You can attract and recruit the best of employees with your Cloud auditing.

Auditing need not be a loss leader to obtain consultancy work.

Audit work can be a profit centre.

Financial statements are first prepared from separate accounts production software.

After that, this audit software is used to record your audit work.

A mini Disclosure Checklist is included

Updated Continually for

The audit file content is based on audit work experience gained in small, medium and large audit practices in London and Bermuda. The clients included subsidiaries operating in UK, USA, Canada, France, south east Asia and the Caribbean.

The lead-author orgaised monthly 3-hour Continuing Professional Development (CPD) lecture sessions and Q & A over 14 years. In these sessions, more efficient audit work methods were discovered and audit work duplication was excluded. CPD lecturers were Jaffer Manek, Paul Soper, Mark Lloydbottom, Stephen McAlpine, Tim Palmer and many more.

Weak audit files result in Audit Monitoring Inspectors imposing Hot File Reviews, Cold File Reviews.

* Audit practices engaged the lead-author on a fee-paid basis to carry out structured audit file reviews to produce reports in the formats of their audit regulator (ICAEW, ACCA).

* The lead-author discussed the report to devise improvements for enhancing their audit files under the International Standards of Auditing.

* The lead-author carried out one-to-one consulting and customised re-training to devise remedial solutions for an early release from the Audit Monitoring Inspectors’ onerous restrictions and the expensive external audit file reviews.

* These remedial solutions are built into this software for users to avoid such pitfalls.

Users’ Audit Monitoring visits therefore can go more smoothly.

Latest developments, update technicalities, efficiency techniques learnt from seminars conducted by

– ICAEW Audit Faculty

– FRC (Financial Reporting Council), Accountancy Age journal, and others.

This software can be used in all countries worldwide since it complies with ISAs.

Read more https://en.wikipedia.org/wiki/International_Standards_on_Auditing

Audit programs did not exist for independent audit firms in the past.

1985 – First version InPractice Audit File on card, users photocopy to make paper file

1987 – 8 inch floppy disk, electronic version, MS Excel driven by MS Visual Basic, print to make a paper file.

1988 – 5.25 inch mini-floppy disk

1990 – 3 inch compact floppy disk

1993 – CD

1995 – DVD

2001 – Download from a link in email

2020 – Cloud. Login whenever, wherever. Signed-off audit files arrive in PDF format.

With ongoing upgrades for 30 years, InPractice Audit File is mature and sleek, much loved by its users in 30+ countries.

InPractice Software is a division of Affilica InPractice Software Ltd, a company registered on 10 December 1985, Registered Number 01969932 at Companies House, U.K.

Lead Author and Technical Director: Jaffer RH Manek https://www.linkedin.com/in/jmanek/

Strategy consultant: Sue Evans https://www.linkedin.com/in/sue-evans-55803611/

Affilica International is a related service. Accountants and lawyers are in a good position to refer their own clients’ out-of-country professional work to you. However, ultimately it is the client who decides whether to engage your practice or engage your rival instead. Instinctively clients worry about putting their business future in the hands of a stand-alone practice located far away. Since clients feel it is safer to engage a practice in an international group, you need to display your membership in Affilica International. Existing clients stay longer when they see you are with Affilica International. www.AFFILICA.com

All rights reserved. Without the prior written permission of Affilica InPractice Software Ltd, this material may not be reproduced, in full or part, in any format including photocopying, printing, electronic memory storage, scanning, recording, retrieval system and such like. Purchasers of this product may save/print any part of this product for use only within their professional practice. This concession under the copyright does not extend to sale or passing on of copies to third parties and/or firms associated to or grouped or assocuiated with the purchaser. Anyone discovered breaching the copyright will be prosecuted and complaints will be lodged with his/her professional body. Whilst every care has been taken to ensure the accuracy of the contents, no responsibility can be accepted for any loss occasioned to any person or corporate acting or refraining from action as a a result of the information contained herein or using this template.